Most organisations misunderstand their own sales forecasting methodology. They only want to delve into it when they feel something is wrong. And by then, the calf has often drowned. Companies assume that sales forecasting is a leading indicator because it literally predicts how turnover will change periodically - classic, right?

In reality, however, forecasting is a lagging indicator because most people do not disconnect their forecast from their plan and results. You cannot wait until the end of the period to take impulsive actions when you have missed your target. That's like stepping on the scale only to do sit-ups because you don't like the number. Too little, too late!

What is Sales Forecasting?

Sales forecasting is the use of expertise, historical data, sales activity data and predictive analytics technologies to estimate sales volume and subsequent revenue in a future period. Almost every sales team, and certainly every successful sales team, has a method for forecasting sales. A good sales forecast uses real data to estimate what results are likely and does not rely on guesswork. Sales forecasting is important because it can help in planning resources and hiring, projecting budgets, risk management and more.

Read more if you want to know what Advanced Sales Forecasting at Trendskout involves.

It is then important to understand that a sales forecast should be used to guide your process, not the other way around. But first, let's discuss some of the methods commonly used to forecast sales.

Sales Forecasting Methods

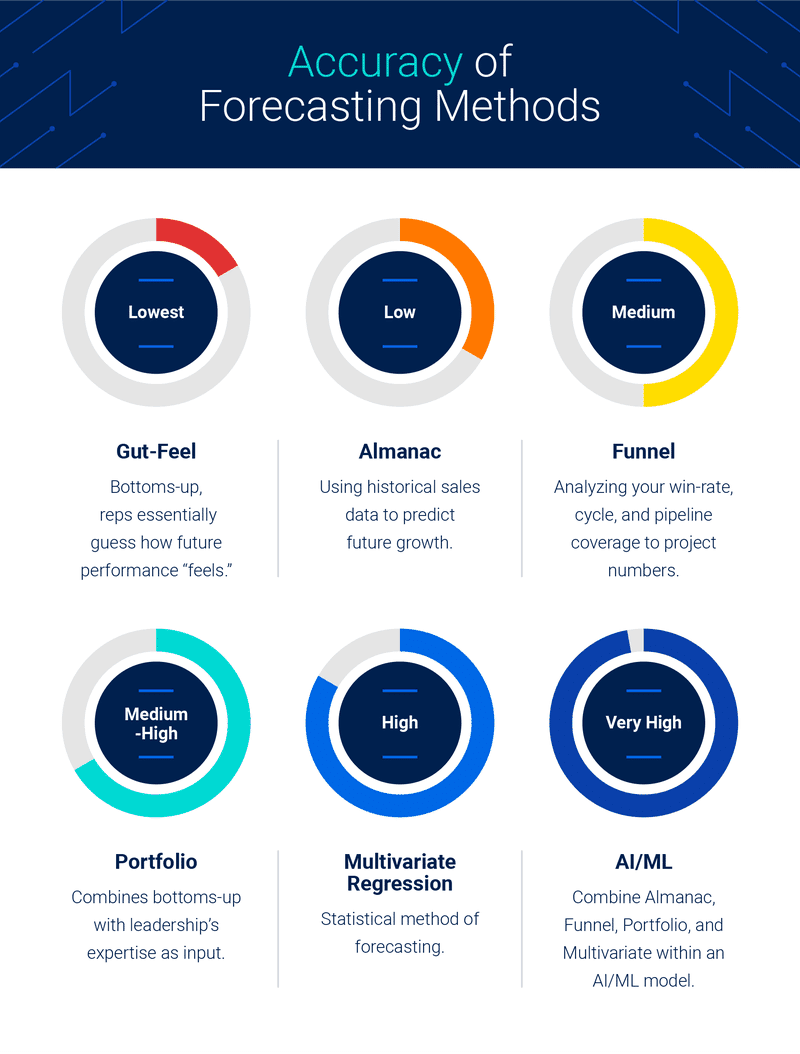

Over time, sales forecasting methods evolved significantly. Often driven by technological advances. Below you will find all sales forecasting methods over the years. From the most rudimentary methods to the most complex and advanced. This also goes hand in hand with the expected accuracy levels of each forecasting method:

"Gut-Feel Forecasting" or gut-feel forecasting

This is literally when you ask your sales reps how they feel about their deals, how likely they are to close and when they expect them to close. So, it is a bottom-up approach. But, this method is the least accurate and it's like flying without instruments in 2023 - way too risky.

We do not recommend this method, but wanted to talk about it for completeness. It is mostly used by smaller sales organisations, teams with fewer deals, longer sales cycles, larger contract value and in more traditional sectors. These companies rely on the experience of their sales reps and managers to predict the future.

Almanac Method

Using historical data to predict future performance is called the Almanac method. Using historical data and a growth projection can be slightly more accurate than simply going by your gut, but there are some drawbacks.

The Almanac forecasting method does not take "climate change" into account. If there is an industry shift or macroeconomic volatility, historical data may no longer be relevant. The year 2020 illustrates this problem, as forecasts based on data from 2019 became useless.

For example, in this example, when the CFO approaches the sales manager to forecast Q2, he immediately looks at the previous year's Q2 performance data compared to other quarters, as well as Q2 trends over the past decade. The manager also looks at the historical sales activity data of their reps to discover trends in each member's skills and rhythm in closing deals.

This forecasting method is useful for established companies with a lot of historical data to draw from. The larger the backlog of performance data, the more accurate the forecast is likely to be.

Funnel forecasting

Understanding how your funnel is performing, such as your win-rates and average sales cycle time, can help guide your forecasting methodology. We call this the funnel forecast.

As an example, if your sales cycle time is two months and your win rate averages 40%, you can use this information to forecast based on your pipeline coverage. If you have 10 opportunities of €1 million each, a safe forecast for the quarter would be €4 million.

Funnel forecasting depends heavily on the coverage, health and hygiene of your pipeline. The longer your sales cycle time, the more important this becomes.

This forecasting method is most useful when your deals are homogeneous and therefore consistent and predictable based on their status in the pipeline.

Portfolio forecasting

Just as a portfolio manager uses financial data to forecast performance and hedge risk's, a sales team lead uses his experience and expert opinion combined with available sales data to forecast.

This method uses the various prediction strategies already discussed and combines them to arrive at a more accurate prediction.

For example, a sales manager has evaluated historical sales data, assessed the pipeline, discussed with her reps how likely they are to close deals, and can now combine her expertise with real data to make a forecast.

This method of forecasting can also help mitigate risk's. For example, if the manager forecasts that it will be a quiet quarter, he can shift internal resources to focus mainly on the upsell from existing customers, knowing that this additional revenue would be more profitable and sustainable.

Multivariate regression

Multivariate regression is a statistical method for predicting sales that uses multiple variables as inputs that affect the desired output, usually sales. The change in each variable will have a corresponding effect on the predicted output.

The multivariate regression approach relies heavily on completeness and accuracy of data, as these values are used to analyse and predict previous and future performance. Multivariate regression forms the basis of machine learning - a topic we will discuss in more detail shortly.

In this example, the CFO asks the sales manager for advice and then the manager seeks the help of her data analyst to perform a regression analysis. The analyst takes previous sales activity and the results of closed opportunities (won or lost) and can then analyse current sales activity to determine the likelihood of winning a particular deal.

Companies using multivariate regression tend to be more sophisticated and data-driven in their sales approach.

From sales forecasting to advanced sales forecasting

This brings us to the most advanced - and powerful - method for sales forecasting. Modern machine learning algorithms are trained on historical data and are assigned weights and biases by the algorithm to learn the expected outcome. ML and AI learn from the data in ways that even the developers are not aware of or do not understand why.

If the ML algorithm is sufficiently trained and tested, the data can be analysed in real-time to produce rolling predictions and highly accurate forecasts. Many ML models have accuracy rates in the 99th percentile, with an understandable and acceptable margin of error.

As an example, train a model on sales team data, including some characteristics (data points) such as date, number of days from opportunity to close, contract value and outcome. By training on this data, the model extracts information about seasonal influences, the impact of contract value on the sales cycle, and more, which can be used to input similar data (without the outcome) and accurately forecast.

Want to see this form of Advanced Sales Forecasting at work? Get a first impression of how this can work for your company? Then book a no-obligation demo with our team.